swap in forex means

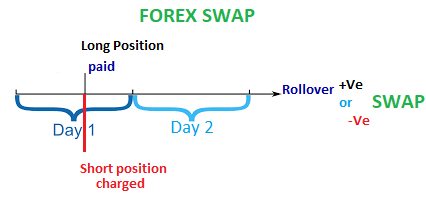

Swap long used for keeping long positions open overnight and Swap short used for keeping short positions open overnight. They are expressed in pips per lot and vary depending on the financial instrument youre trading.

What Is The Swap In Forex How Does It Affect Trading

What is Swap in Forex.

. A swap long fee will be applied when traders keep long positions open overnight and swap short will be applied when. The difference between the interest rates of two countrys currencies is called the interest-rate differential. So you will either be paid out at the end of the day or you will have to pay in.

A Swap in Forex is an interest payment that you either settle or collect for carrying positions overnight into the following day. In effect you agree with us as the counterparty to take a view in one currency before swapping it back at a date of your choosing with any running profits or losses cash. There are two types of swaps.

Sign Up For An Account Today. When you trade forex you express a view on the direction of a currency pair by buying or selling the base currency first-named currency with profit or loss made in the quote currency second-named currency. A swap which is also known as the rollover fee is the cost you need to pay if you keep a position open overnight.

The interest rate for each currency is determined by the countrys central bank. Forex swap rate or forex rollover represents the interest that traders can earn or pay on positions held overnight on the Forex market. In Forex trading the interest rate paid or received by a trader is called a swap.

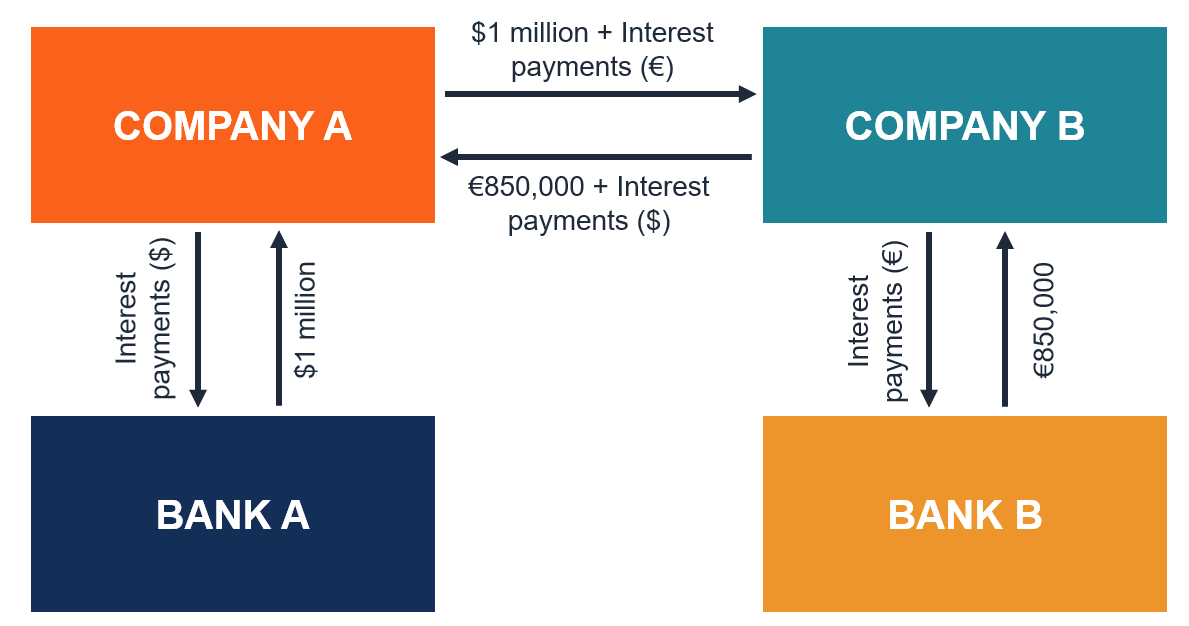

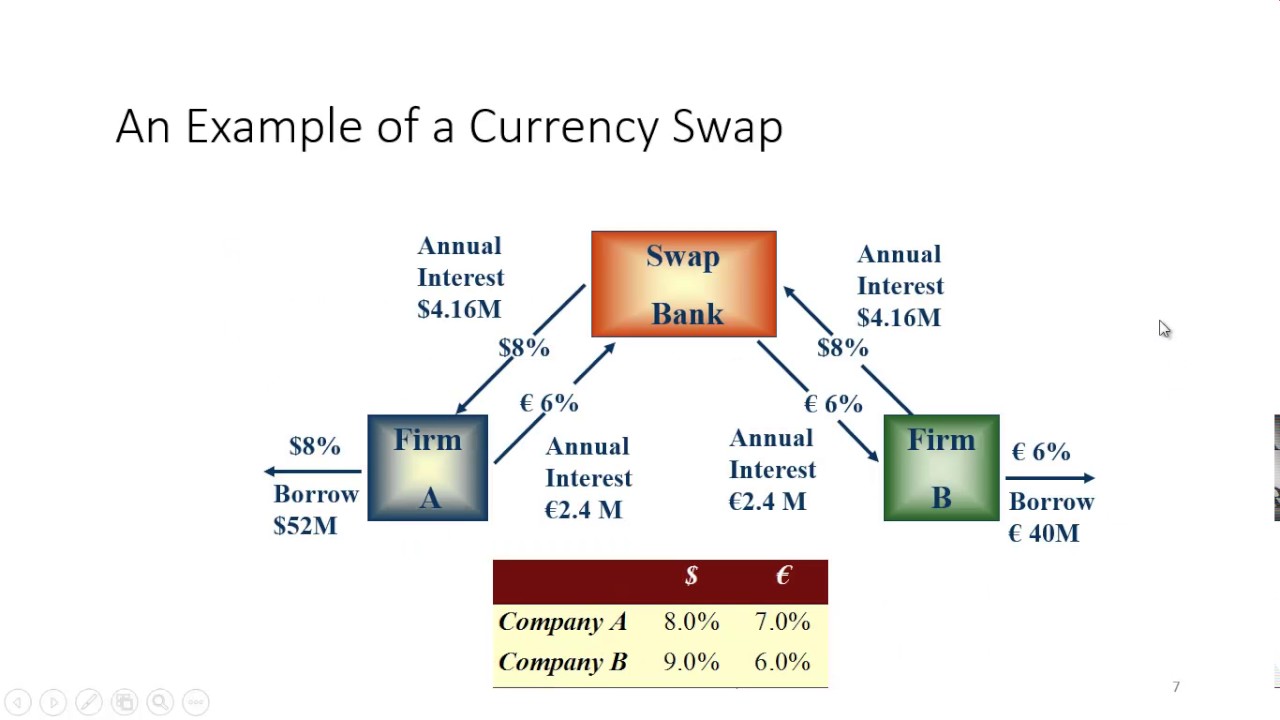

Swaps as Trading Products. In finance a foreign exchange swap forex swap or FX swap is a simultaneous purchase and sale of identical amounts of one currency for another with two different value dates and may use foreign exchange derivatives. Swaps are a type of derivative trading product but the word is also used to describe the interest that is either earned or paid on overnight CFD and forex trades.

In this article we describe both and clear up the difference and then go into a little more detail on how swap rates apply to CFD and Forex trading. There are two types of swaps. When you trade on margin using leverage and hold a position overnight you receive interest on your positions that involves buying currencies of a country that has a higher interest rate and contrary to that you pay interest on positions selling such.

Whether a trader receives or has to pay a swap depends on the interest rates of the individual currencies in a Forex pair. A swap in forex is an interest charge for holding an open position overnight. Each Forex pair has its own swap charge affected by market conditions and the interest rate associated with countries of the chosen Forex pair traded.

An FX swap allows sums of a certain currency to be used to fund charges designated in another currency without acquiring foreign exchange risk. Ad Trade The Global Currency Markets With Confidence. Instead a swap in Forex is an interest fee which needs to either be paid in or will be charged added to your account when the days trading comes to an end.

The swap fee can be applied if traders hold the positions at the daily rollover point which is 0000 server time or tomorrow next. Swap charges are also referred as rollover fees. The first swap is a long swap.

Dedicated Support Provided Including Client Support To Help Your Specific Trading Needs. What is a swap in Forex. The swap agreement always says what is exchanged when the exchanges happen and what are the prices of the exchange.

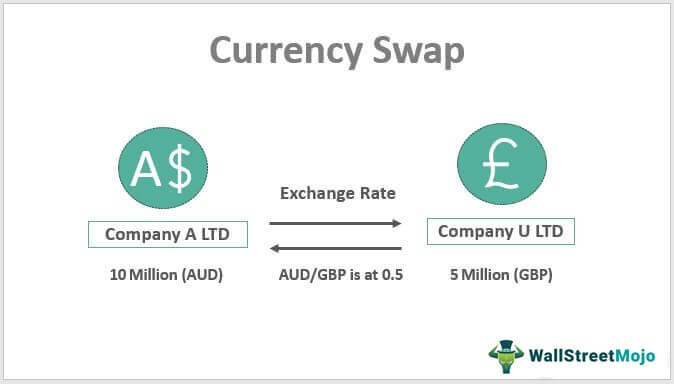

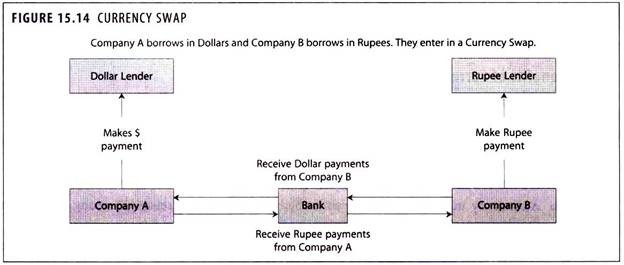

If this isnt the first article that youve read about Forex Swaps then we sympathise. In simple words swap is a special operation that carries an open position in a trading instrument overnight for which the difference in interest rates is credited or charged. A foreign currency swap is an agreement to exchange currency between two foreign parties often employed to obtain loans at more favorable interest rates.

Forex swap is not actually a physical swap. Swaps in Forex play an important yet confusing role and they affect your trading strategy sometimes without you even noticing. What is the meaning of swap in forex trading.

Swap in forex trading is simply the interest rate that is either paid or charged to you at the end of each trading day. A swap in forex refers to the interest that you either earn or pay for a trade that you keep open overnight. Basically a swap is the interest rate differential between the currencies in the pair that you are trading.

Swap in forex is an agreement about the exchange of currencies at the start and reversal exchange at the end of the contract. When trading Forex or other CFD Contract for Difference financial instruments swap also known as rollover refers to the interest paid or received for keeping a position overnight.

Swap Definition Forexpedia By Babypips Com

What Is A Swap How Can It Benefit Us In Trading Forextrade1

What Is The Meaning Of Swap In Forex Trading

Explaining The Meaning Of A Swap On Forex Examples Of Use

What Is Swap In Forex Trading How Does It Works

What Are Swaps In Forex Forex Academy

:max_bytes(150000):strip_icc()/dotdash_final_Currency_Swap_vs_Interest_Rate_Swap_Whats_the_Difference_Jan_2021-01-d0d9bf99a16c467daeab2fd073b67051.jpg)

Currency Swap Vs Interest Rate Swap

The Ultimate Guide To Forex Swaps Forex Academy

Would You Be Interested In A Circus Swap In Forex Double In A Day Forex

Currency Swap Definition Example How This Agreement Works

Currency Swap Meaning And Benefits Foreign Exchange Financial Management

Currency Swap Quantra By Quantinsti

Forex Trading Academy Best Educational Provider Axiory Global

/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)

:max_bytes(150000):strip_icc()/DifferentTypesofSwaps2-4de5ab58b9854ca6b325de77810c3b16.png)